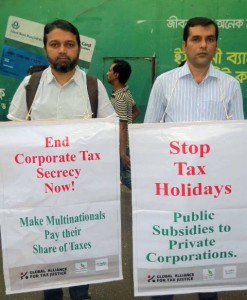

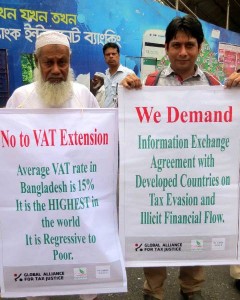

As a part of Global Week of Action for Tax Justice, today more than 20 rights based civil society organizations including farmers and labor organizations led by EquityBD has organized a human chain in front of national press club and demand to ensure Tax Transparency of MNCs (Multinational Companies) in Bangladesh. They also demand to publish a white paper on illicit finance flow and with government’s action strategies to recovery from different Tax Heavens countries like Malaysia, Switzerland Canada. The right groups criticize the government for imposing VAT expansion and her foreign resource mobilization planning which created debt burden and peoples plight in their livelihood. Rather stopping illicit finance flow that will be easy to necessary resource mobilization they said.

As a part of Global Week of Action for Tax Justice, today more than 20 rights based civil society organizations including farmers and labor organizations led by EquityBD has organized a human chain in front of national press club and demand to ensure Tax Transparency of MNCs (Multinational Companies) in Bangladesh. They also demand to publish a white paper on illicit finance flow and with government’s action strategies to recovery from different Tax Heavens countries like Malaysia, Switzerland Canada. The right groups criticize the government for imposing VAT expansion and her foreign resource mobilization planning which created debt burden and peoples plight in their livelihood. Rather stopping illicit finance flow that will be easy to necessary resource mobilization they said.

The human chain is moderated by Mosafa Kamal Akanda of EquityBD and there spoke by Md. Ahsanul Karim from same organization. Among the other speakers were Subol Sarkar of Bhumihin Somity, Prodip Kumar Roy of Online Knowledge Society, M Hafizul Islam of PSI (Public Service International), Aminur Rasul Babul of Unnayan Dhara Trust and Syed Aminul Hoque from EquityBD.

Md. Ahsanul Karim said that UK-based research organization-“Tax Justice Network” published a report on Financial Secrecy Index (FSI)-2014 as on 2-November, 2015. The report revealed the role of 92 countries in maintaining financial secrecy and the top ten countries are Switzerland, Hong Kong, USA, Singapore, Cayman Island-UK, Luxemburg, Lebanon, Germany, Bahrain and Dubai. He mentioned that the developed countries are paying $135 billion to poor countries as foreign aid in exchange of $1-$1.6 trillion as illicit financial flow to the developed countries, i.e. against every US$1 of foreign aid, US$10 is siphoned off to the developed countries. He also added, in every year an amount of BDT 200 billion through hundi, BDT 100-160 billion through miss invoicing and about BDT 500 billion through money laundering to other countries. Thus govt. is losing huge amount of revenue in every year.

M Hafizul Islam of PSI said that, a total of US$18.41 billion had been siphoned off Bangladesh in 10 years since 2003 through trade miss-invoicing, corruption, bribery and tax evasion by a report of Washington-based Global Financial Integrity (GFI). That means, government could earn near about BDT 360 billion as additional revenue and would able to invest it in the development program.

Aminul Hoque said that, poor people are crippled due to paying of higher rate VAT, debt burden and debt servicing liabilities during last year’s. Govt. needs to realize this through taking appropriate action and strategies for stopping illicit finance flow to ease the people livelihood along with pro poor resource mobilization technique.

Subal Sarkar stated that a total tax of more than $402 million have been evaded by the four major mobile phone multinational companies in Bangladesh namely Grameen Phone (Telenor), Banglalink (Orascom), Robi (Singtel) and Airtel (India) through SIM card replacement. Other Multi National Company like British American Tobacco Company has also been accused for tax evasion of around $250 million through false declaration of raw material import.

Aminur Rasul Babul mentioned that for Bangladesh, it is not impossible to get the information on money laundering, after an agreement signed on July-2013 with the International Agency “Augment Group” to protect money laundering and terrorist financing where other 147 countries are included. For that, Bangladesh will have to sign with Switzerland for information exchange regarding tax or money laundering. He also added that, the CSO across the world, are urging for a Redistributive Justice for a post 2015 world based on the unsatisfactory achievement of MDG, we can’t afford the MNCs go untaxed since it only creates inequality.

The right groups demand, (1) Any Bangladesh citizen holding duel passport and have transaction with Bangladesh, must submit their bank and assets information. Punishment should be imposed if tax evasion found. 2) Govt. have to prepare a white paper and make it public on how many Bangladeshis have taken Malaysian Second Home and other citizenship advantage through financing transaction from country. 3) Inter-governmental agreement to be signed with different countries e.g. with Switzerland to exchange bank transaction information of Bangladeshi people as well as foreigners those are working in Bangladesh. 4) Develop legal procedure and stop illicit financing through Hundi. 5) Multi National Co. must disclose their investment and their income. MNC must pay their fair share of taxes 6) White Paper has to be disclosed on financial plundering by Bismillah, Hall-Mark group and other state banks and share market. 7) Govt. should replicate Indian initiative and introduce TIN (Tax Identification Number) for any purchasing or transaction above $2,000 with no cash transaction. If any irregularities found, assets should be seized at once.

Please Download Related Paper [Bangla press] [English Press] [Position Paper]

Photos

|

|

|

|

|

|

Newspaper Link

| |

|

|

|